5 things we all want to ask about the speculation tax You’ve probably already heard about this new term that’s been bouncing around Vancouver for the last couple of months. Almost anywhere you go, you hear it. Someone, somewhere is whispering about it. “Speculation tax” they say. Maybe it’s come up in casual conversation or you briefly read about it online. But do you know exactly what it means? Recently, the government has introduced a legislation for the speculation tax despite there being some protest from local mayors and development communities. With this tax, there are many questions that might come to mind. Do you know if it directly affects you in some way or another? Will it do more harm than good? These are questions on all our minds and we’re here to answer them for you.

1. First of all, let’s break it down and start from the beginning. What is the speculation tax?

The argument from proponents of the tax say that there are many foreign (abroad and out of province) buyers squeezing their money through the cracks in the system and buying into the local housing market. They also say that the buyers let the houses sit empty and unattended. We’ve all mentioned them in conversation before. And let’s be honest, our family, friends, and colleagues may have had some choice things to say about them. Let’s take a look at one of the arguments of what absent owners did to the market. It goes that they drove housing prices up significantly and made the affordability of housing miles away from achievable for many Vancouver residents – i.e. the people who actually live in the city. Because of this, the government decided to do their part and get after them. And here’s where the speculation tax comes in. It’s a tax that is applied on properties that are not the primary residence of the owner. This means that if someone buys a house in BC and doesn’t live there, they have to pay this extra house. If the house is left unattended and isn’t even occupied by any kind of tenant, the owner will have to pay this speculation tax.

2. What’s the point of the Speculation Tax?

In short, the speculation tax focuses on getting after the people who treat our housing market like a stock market. It’s difficult to truly measure what portion of the buyer pool actively practices real estate speculation. One side of the argument is, that all purchases with appreciable capital gains is an investment, primary and secondary homes included. In extreme cases it can look ridiculous for an investor to buy up 10 condos in a building to let sit empty, using it as a bank account. The speculation tax targets these types of buyers.

3. Will you be affected if you have a cottage?

Don’t worry! You’re safe. If you have a cottage on the lake or on the island, you won’t have to worry about it. People with second homes outside of the high-cost, designated urban areas do not have to pay the tax. The target of the tax are those people who are clearly taking advantage of the market and leaving homes vacant only to drive up the prices.

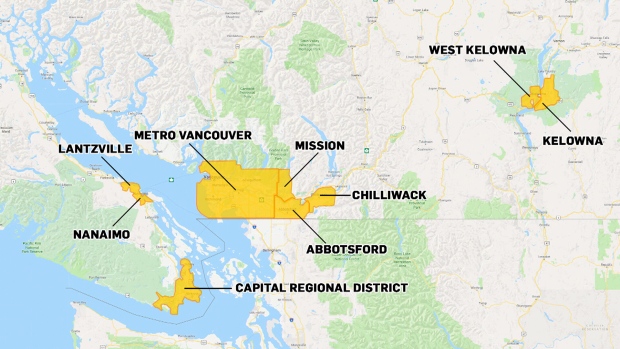

Be warned though. If you have a second property within Metro Vancouver, the Capital Regional District, Kelowna, West Kelowna, Nanaimo-Lantzville, Abbotsford, Chilliwack or Mission, you could be hit by the tax.

4. Do you have to pay the same tax rate if you’re a resident?

The tax rate is different depending on where you’re from. If you are a BC resident, you are subject to 0.5 per cent. If you are a Canadian outside of BC, you are subject to 1 per cent tax rate. While non-Canadians will be subject to a 2 per cent rate.

5. What are some concerns about the tax?

You may have heard that a lot of people are worried about the tax having a reverse effect that will actually discourage the development of new housing. This is one of those topics that is being debated on by academics. Their opinions seem to be divided. Who is right and who is wrong?

One of the claims some academics have made is in regarding to the name of the tax. Why call it speculation tax when it is less about speculation and more about vacancy. There is some fear that it might discourage long-term development.

There is still so much about the tax that is uncertain. What will the future hold for BC real estate? Will it succeed in generating $201 million in revenue as predicted by the government? Will it affect more Canadians than foreigners? Is the tax only a short-term solution for something too large scale to predict?

The BOC just raised interest rates by 25 basis points to 1.75%. It is expected to go up 4 more times in 2019. With so many factors stacked against purchasing real estate, we can only wait until spring to see the direction the market goes. We are uncertain about how this tax will affect the future of our real estate market. We can only hope that it works out for the best and in favour of the people of our community.

Sources:

Speculation tax tabled by BC government

https://vancouversun.com/news/politics/government-tables-legislation-on-speculation-tax

https://vancouversun.com/news/local-news/b-c-speculation-tax-heres-what-you-need-to-know

Opinion: Will the speculation tax proceed or fail this fall session